- Neo Tokyo News

- Posts

- Neo Tokyo News: 18 - 27 Jan 2025

Neo Tokyo News: 18 - 27 Jan 2025

The RAGING Bull Market (where price only goes down)

Neo Tokyo News: 18 - 27 Jan 2025

In this issue:

This Week in Neo Tokyo: The RAGING Bull Market (where price only goes down) (by PhoenixxDown)

The Markets Are Exhausted (by Flower83)

This Week In Neo Tokyo:

The RAGING Bull Market (where price only goes down)

A big day ahead. Arthur Hayes has predicted a pullback to $70K for Bitcoin, so keep an eye out—after all, the man has never been wrong.

Once that either happens, or doesn’t, a few hours later, we’ll be live on Market Monday to discuss Abstract’s imminent launch, recent airdrops of $ANIME and $JUP, and whether we’re gearing up for the next leg up for AI Agents.

As soon as Market Monday wraps, it’s time for the first Town Hall of 2025, and this one’s not to be missed. Firestorm and the Council will be sharing some exciting announcements and aligning our goals and priorities for the coming year.

See you there!

This Weeks Neo Tokyo Content

Interlinked #65 - This week features the welcome return of Crasher, the big boss at Shibuya Mall. Together with Ben and Nick, they dive into the significance of merchandise as a tool for community building and branding. They discuss the concept of “merch as a service,” the challenges communities face managing merch internally, and how AI is shaping design and manufacturing.

Market Monday - The title of this episode was “Supercycle Confirmed!!” I’m once again left no choice but to apologize for our return to the Jim Cramer gimmick. We’ll be deploying some Flower bearishness in today’s Space to bring balance. Other topics discussed include SOL winning and ETH losing their long-standing war, and whether this cycle will be remembered as the “Crime Cycle.” Listen back here.

NT x Unfungible Space - As earlier mentioned, Abstract dropping is just around the corner, and this session goes into why you should care about it. If you’ve been fading it or just haven’t got round to it yet, time is of the essence—listen back to the recording now and get up to speed.

GAIA Everworld AMA - Brian H., CEO of the immersive, multi-region fantasy game, joined Ben and Nick to talk about GAIA Everworld. Players can engage in PvP battles, quests, and exploration while immersing themselves in an open-world MMORPG. Listen back here. Listen back here.

Slingshot DAO AMA - Zac from Slingshot joined the AMA team for an insightful discussion about their DAO, which empowers members to fund, build, and support decentralized projects. With over 3 million active monthly players, there’s a lot to unpack here. Catch the recording.

Short Scoops

Sentiment Check: Our old friend Shamsi breaks down this week’s market sentiment. Top? Bottom? Get some clarity:

𝕏 was full of noise this week.

Half the timeline is calling for the top, while the other half thinks we can go higher.

🧵I complied the top 6 tweets to help you wrap your head around the madness.👇

— Shamsi (@CryptoShamsi)

11:22 AM • Jan 25, 2025

The FullTop Indicator: Citizen SanSerif has been hard at work. Check out their post and take advantage of The FullTop Indicator, free for the next three months:

(1/3)

Where are we in the cycle?

AT traders, macro analysts, on-chain guys argue with each other.Nobody agrees and it sucks.🤮

All this in a psychological context that misleads everyone 90% of the time.🤡

So...

I decided not to choose and to consider all areas, all branches.… x.com/i/web/status/1…

— SanSerif (@0xSanSSerif)

2:42 PM • Jan 24, 2025

Advice for the Disillusioned: If you’re feeling lost, frustrated, or underwhelmed by this ABSOLUTELY RAGING bull market (where prices seemingly only go down), Race4TheWin has some words of wisdom:

Did you miss the Trump trade? Are you feeling discouraged?

Throw that emotion out and lock in! Know we are in a space where 5-6-7 figures wins can be made in just 12 hours.

Look at this as an example of possibility and buckle down. We are lucky to have these opportunities… x.com/i/web/status/1…

— Race4TheWin (@Race4W)

12:59 AM • Jan 21, 2025

“But ser, any $BYTES news?” No news, but here’s a little reminder for the faithful:

Imagine the story

You faded $5

And then all the sudden

ByteStreet launches

Catching you completely sidelined

The ticker is $BYTES

— Ktrap (@ktrap)

12:08 AM • Jan 25, 2025

NT Plays Game Nights: Want to see your favorite games featured? Tag the projects and let them know:

Quality games building on @AbstractChain, hit us up in DMs and let's play!

— NT Plays (@NeoTokyoPlays)

1:40 AM • Jan 23, 2025

Until next next week, citizens.

The Markets Are Exhausted

It's funny how fast the timeline can get bearish on Crypto Twitter. But, look, I am not saying that the entire bull run is over, I’m just saying it might be.

They call me “Flower the Bear,” but one of these days, I will be right. Just you wait.

Anyway, the fact is that there are multiple bearish arguments to be made at this point in the cycle. In fact, let's go over a few, and then you can make up your own mind.

The Price Action Itself

If we simply look at the charts we can see the distribution pattern in action.

We ran up from the lows, creating (one last?) ATH, and are now failing to displace above $110k with any conviction, despite the supposed bullish macro elements in the markets. It certainly looks like buyers are exhausted here.

Furthermore, we thought that there are many corporations (such as BlackRock, Fidelity and other governments and banks) buying insane amounts of Bitcoin. As it turns out, this was not true after all:

guys I have some bad news

BlackRock is not buying

In fact, they are selling

— Arkham (@arkham)

7:13 PM • Jan 9, 2025

In fact quite the opposite might be the case now; as we have seen many other entities looking to sell their BTC. Ross Ulbrich, the U.S Government…..and.…China?

Charts tell a story. Maybe it is time for us to listen more closely.

Charts tell a story. Maybe it is time for us to listen more closely.

Trump and His Wife Launching Coins

It’s no secret that this was, in hindsight, not a bullish thing. In fact, besides this being one of the most top-signal-ish signs in a while, it also acted as a HUGE liquidity sink with some people even seeing the event as analogous to what Yuga’s Otherdeed NFT collection did to the NFT space back in 2022.

Honestly, I can see this too. The whole space was bleeding after Trump announced his coin and all the liquidity was getting siphoned out of the web3 space into $TRUMP.

It became clear to many people that the Trump family and people near them are not here to pump our bags, or as some suggested, use those gains to buy Greenland or alleviate the US national debt.

No, you silly goose! They are here to enrich themselves just like every other market participant.

Fragmented Liquidity

This cycle sucks because there are so many coins, L2’s, NFTs, and memes launching that it seriously compartmentalizes the web3 space as everyone fights for attention and wants to retain their user base, but in order to do that everyone has to scream louder than others.

Many projects are rushing to have their TGEs knowing that this party won't last forever.

This looks like an exhausted market

Does it mean we go lower? Possibly, but it's important to understand the reasons for the exhaustion.

This time, the sentiment exists for different reasons than the usual pre-dump exhaustion periods.

- You had the most generational wealth… x.com/i/web/status/1…

— gum (@0xGumshoe)

11:33 AM • Jan 23, 2025

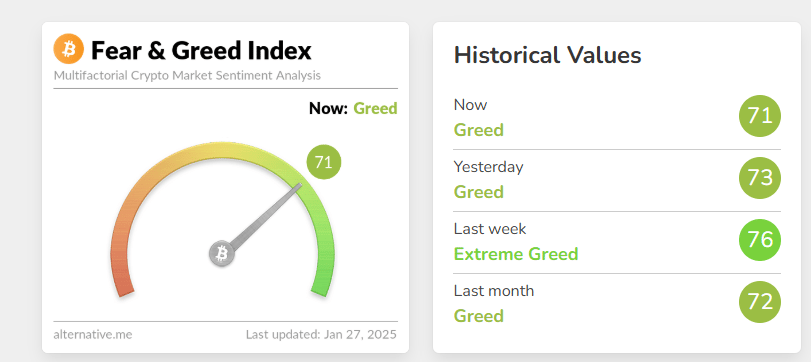

It has become quite a (profitable?) joke that you should fade whatever the masses say on X. Everyone was doomposting in despair at range lows the last time we were at 90k BTC. But this time we are still trading at above 100k and people are far from euphoric, even though the Fear & Greed Index is showing positive sentiment

As if this was not enough we have crypto news outlets thinking that certain braindead takes are bullish signals.

🔥 BULLISH: The CEO of Morgan Creek Capital suggested $XRP, Cardano ($ADA), and Hedera ($HBAR) as potential assets for Trump’s crypto reserve.

He noted that the founders of these projects are building ties with the Trump family, particularly Eric Trump.

— Cointelegraph (@Cointelegraph)

8:50 PM • Jan 22, 2025

The ETF Listings Having a Decreased Impact on Coins

it’s not a great sign that ETF filing announcements appear to no longer matter to the coins

— Zack Voell (@zackvoell)

10:49 PM • Jan 22, 2025

Another interesting thing to observe was just how little the markets care about objectively bullish data at this point.

In recent days we have seen a lot of projects securing their ETF listing but with no real positive impact on price action. DOGE for example, would absolutely run if news of its ETF would be announced last cycle. Or if the entire government department would be called DOGE. Instead, the price barely moved after ETF news.

INTEL: $XRP AND $SOL CME FUTURES TO GO LIVE FEB 10TH PENDING REGULATORY REVIEW

— Solid Intel 📡 (@solidintel_x)

7:35 PM • Jan 22, 2025

The same thing could be said for $XRP and $SOL but these two kinda ran hard before the ETF news was announced, so let's reserve judgement for now.

Not all hope is lost, however; this probably means that even if BTC and major coins are indeed cooked for a while, we might enjoy some gains in other niches of web3 that are lagging behind. One such example is probably the upcoming NFT Season on Abstract.

Tune into our newsletter for juicy alpha on that topic sometime in the future.

All content from Neo Tokyo News is for entertainment purposes only, and not financial advice.

That’s it for our 82nd edition of the Neo Tokyo Newsletter. Be sure to subscribe and share with your friends so you don’t miss out on future content.

Make sure to also follow Neo Tokyo News on Twitter.

And check out our Neo Tokyo News Website.